Navigating High Interest Rates | Vol. 15

“Tell me your price and I’ll tell you my terms”

-Investing Adage

For The Millionaire Real Estate Investor, we interviewed more than 120 millionaires. These were investors who had amassed real estate portfolios with over $1 million in equity. After analyzing those interviews, we discovered the key to their outsized success came from a mastery of three things — criteria, terms and network. That’s the 20 percent for investing. Today, we focus on terms.

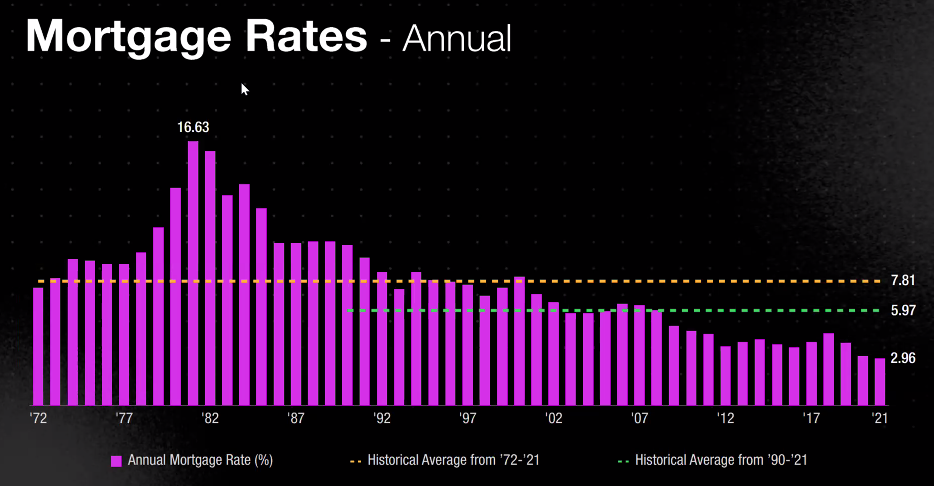

Why terms? With mortgage rates at 15-year highs, it’s never been more important to understand how to negotiate terms for the win.

“Terms” include all the negotiable aspects of a real estate transaction. A short list would include price, down payment, interest rate, repairs, occupancy, and closing costs. Since the pandemic set the market ablaze, we’ve been negotiating appraisal waivers and, maybe, whether or not we get the home inspected at all. Our singular goal was to get an accepted buyer offer in an incredibly lopsided seller’s market.

Mortgage rates have shifted that balance. Inventory is rising rapidly. Affordability has fallen off a cliff. Days on market are starting to stretch. And price reductions are a thing again. Sellers have returned to the negotiating table with lots of equity to make a deal. Negotiation around high rates is something many Twenty Percenters have never done. If they have, it’s been over a decade. It’s time for a refresher.

Mortgage Rate Buydown 101

The terminology around mortgage rates sometimes seems designed to confound. The confusion centers around the meaning of a “point.” If you buy a “point,” the cost is one percent of the mortgage loan amount. In this sense, one point equals one percent. However, buying down a mortgage rate by one point does not buy down the interest rate by one percent. For buydowns, a point equates to 0.25% of the rate. For example, to permanently buy down a 6.5% mortgage rate to a 5% rate, you’d have to buy down the rate by 1.5% (6.5% – 5% = 1.5%) or by six points (1.5% / 0.25% = 6).

Why does it only buy 0.25%? Basically, you’re prepaying some of the interest the bank lost by lowering the rate. A one-point buydown on a $500,000 mortgage loan would cost approximately $5,000.

Clear as mud?

Here’s a quick summation. Buying down one point on a loan costs one percent of the loan amount. A one point buydown will reduce the interest rate by 0.25%.

At the risk of giving you flashbacks to taking your SATs, let’s make this a word problem. You will not need a No. 2 Pencil. But, you can chew on one if it moderates your anxiety.

A seller advertises “reduced mortgage rates available” on their home which lists for $625,000. They accept a full-price offer from a buyer. The buyer will make a downpayment of $125,000, leaving them with a $500,000 mortgage. The buyer stipulates that the seller will have to buy down the rate from 6.7% to 4.7%. On a 30-year note, this will reduce their principal and interest from $3,226 to $2,593 a month. How many points will the seller have to pay and how much will it cost?

A. The seller buys down the rate by 2 points costing $10,000.

B. The seller buys down the rate by 2 points costing $12,500.

C. The seller buys down the rate by 8 points costing $40,000.

D. The seller buys down the rate by 8 points costing $50,000.

The answer is posted below the next section. In the meantime, here are four next steps for you to put this knowledge into practice.

1. Schedule regular meetings with your lender. Lean on their expertise until you really understand this process. Do you know what a “lock and shop” is? How about ARMS and 2-1 buydowns? It’s time to go back to school. My colleague Todd Butzer recently noted that we’ve largely abdicated mortgage expertise to our mortgage partners in recent years. That’s not how it’s always been. We need to master creative finance so we can better inform our clients!

2. Update your buyer and seller marketing to create awareness around the terms that make homes more affordable and get homes sold. This also shows that you are the real estate professional to guide them!

3. Study your local market to understand the delicate dance between price reductions and buydowns. If your seller has equity they have choices. Price reductions create exposure. Buydowns make homes more affordable for a larger group of buyers. This is where the counsel of an experienced real estate professional really pays off.

4. Connect with your fellow Twenty Percenters to stay current with the latest tactics. And always run new programs by your lender and broker to make sure you’re on the right side of lending laws. Loan fraud is the obvious thing to avoid. There are also numerous truth-in-advertising and consumer-protection regulations to navigate.

The correct answer was C. Reducing the rate by 2% will require 8 points at a cost of $5,000 each. Because you’re all Twenty Percenters, I’m sure everyone aced the exam!

One question to ponder in your thinking time: How much time can I commit weekly to mastering mortgage terms for this shifting market?

Make an impact!

Jay Papasan

Co-author of The One Thing & The Millionaire Real Estate Agent

Leave a Reply

You must be logged in to post a comment.