Rent vs Own – The Ultimate Showdown | Vol. 11

Don’t wait to buy real estate. Buy real estate and wait.

-Unknown

Every few years, a debate erupts over the merits of homeownership. Financial gurus and economists publish articles declaring homeownership is for suckers. [Picture me fuming.] I’m sure these articles perform as clickbait, but they lack perspective. They put too much emphasis on how much interest is paid over the life of a loan while ignoring equity build-up and tax benefits during the same period. And, frequently, they ignore basic human behavior and imagine people investing 100% of their savings from renting, month after month for decades.

With mortgage rates on the rise, there’s been a recent spat of “Rent vs Own” articles and videos. Case in point, real estate guru Grant Cardone published a treatise that concluded: “My opinion: Don’t buy a home — unless you can afford to waste money.” Remind me why real estate brokerages feature him as a keynote? Seriously.

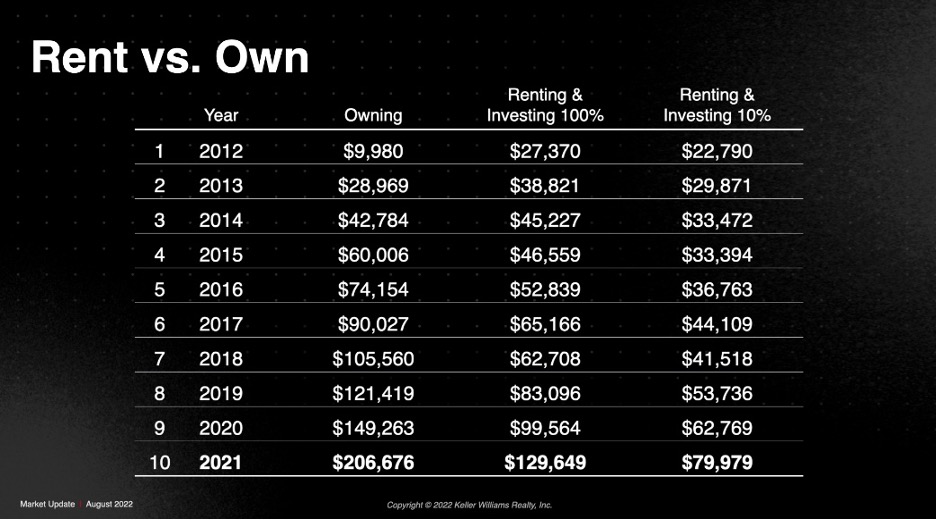

At Mega Agent Camp last month, we decided to punch back. We ran the numbers using actual historical performance (see graphic below). So it’s a bit like a real estate version of the movie Sliding Doors or a Choose Your Own Adventure story. In each of three columns, you go back in time to 2012 and make a different choice around homeownership.

Your three choices are Owning, Renting and Investing 100%, and Renting and Investing 10%.

1. Owning – You listen to your Realtor. Instead of renting, you purchased a median-priced home for $177,200 with 10% down and paid about 4% in closing costs. And then for almost a decade, you let equity build up through price appreciation and the forced savings of paying a mortgage.

2. Renting and Investing 100% – After reading an article on the merits of renting, you rented a median-priced place. You invested the unused 10% downpayment and the unpaid closing costs in a S&P 500 mutual fund. With incredible self-discipline, you invested 100% of your monthly savings (from renting instead of buying) in that same S&P 500 mutual fund. You did this for ten years and watched your stock portfolio grow.

3. Renting and Investing 10% – After reading an article on the merits of renting, you rented a median-priced place. You invested the unused 10% downpayment and the unpaid closing costs in a S&P 500 mutual fund. With more (ordinary) self-discipline, you invested 10% of your monthly savings (from renting instead of buying) in that same S&P 500 mutual fund. You did this for ten years and watched your stock portfolio grow.

So who wins? It depends. For a few years, renting can be a better choice. However, the balance tips toward homeownership’s favor between the third and fourth year. Even after all the additional costs, homeownership leaves renting in the dust after that. If you purchased the home, you came out with over $77,000 more in wealth than the superhuman who invested 100% of their savings, and over $126,000 more than the more-averagely-disciplined renter.

This outcome validates advice I’ve heard from real estate pros for the past twenty years…If you think you might be living in an area for at least three years, you should seriously explore buying.

Lifestyle choices are really at the center of this equation. Everyone is different. Thrifty individuals can financially outperform the averages we present. Spendthrifts can undo the positives of all scenarios. Whether we’re buying or renting, a little financial intelligence goes a long way.

Inside the Numbers

You probably have lots of questions about how we arrived at our numbers. I’ll walk you through our high-level assumptions in the next few paragraphs. This might come in handy if your first-time homebuyer seminar is overrun by a gaggle of engineers.

For the homeownership path, we used actual appreciation for each year based on data from the National Association of Realtors. We estimated private mortgage insurance (PMI) at 0.5% of the mortgage until our equity reached 78% of the home value. We got to drop the PMI between year two and year three. We also estimated maintenance (0.1% of the home value per month), insurance (0.25% of the home value annually), and property taxes (2% of the home value annually). We also included appropriate buying costs at purchase and selling costs each year. So the “owning” column represents your net after all costs including commissions.

Two homeownership factors we did NOT include: the mortgage tax deduction (which has too many variables to estimate) and a hardware store addiction (which might include enough garden gnomes to undo your appreciation).

For the two renting paths, we assumed a one-month deposit and used CoStar’s annual median rents for “Class A Residential” costs. Rent started at $1,137/month and appreciated at a 3.6% rate for the decade. We did not account for renters’ insurance.

During this ten-year period, homeownership did great. We enjoyed an average annual rate of price appreciation of about 7.4%. That’s above the long-term trend line of 4%. However, the S&P 500 performed even better, averaging 15% annual growth. We used Yahoo Finance and our imaginary mutual fund has no annual fees. Take that, Vanguard!

Safe as Houses

Researching this article, I stumbled on some amazing research that kinda puts a bow on the front door of your home purchase. A 2017 working paper by the Federal Reserve Bank of San Francisco examined rates of return on treasury bills, bonds, equities, and residential real estate from 1870 to 2015. The headline: “Residential real estate, not equity, has been the best long-run investment over the course of modern history.” They found both equities and housing averaged about a 7% ROI, but that equities were more than twice as volatile. No one really expected t-bills or bonds to win. Low risk is expected to yield a lower return. Housing appears to warp the risk-reward relationship in its favor.

Whether you’re looking at ten years or almost 150 years, homeownership comes with real financial benefits.

I hope this comes in handy next time you’re working with first-time homebuyers. You can also check out our new edition of Your First Home (debuting next Tuesday, September 13, 2022) and the free resources that go with it.

One question to ponder in your thinking time: Can I confidently defend homeownership to someone who thinks renting is smarter?

Make an impact!

Jay Papasan

Co-author of The One Thing & The Millionaire Real Estate Agent

Leave a Reply

You must be logged in to post a comment.